Compliance Asset Freeze Platform

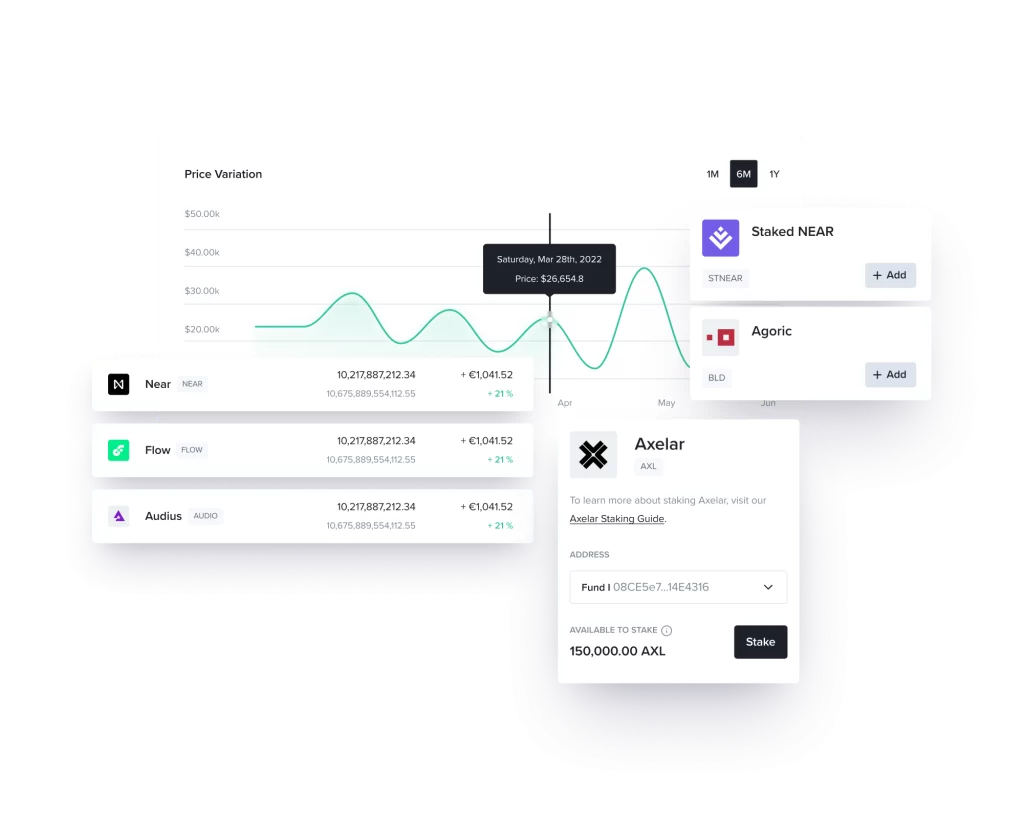

The CAF platform is dedicated to temporary financial asset freezes. It focuses on freezing funds related to financial audits, suspicious assets, or restricted funds, ensuring full compliance with financial laws and regulations. The platform aims to provide a secure and transparent environment to protect clients’ assets.

Financial Security

: Protecting client funds and providing a secure environment for financial transactions through diligent verification and continuous auditing. Innovation: Focusing on developing advanced financial solutions to meet client needs, including investment in modern technology and effective financial tools.

Law Adherence

Ensuring all operations comply with financial laws and regulations, such as the USA PATRIOT Act and the Bank Secrecy Act (BSA). This requires financial institutions to develop anti-money laundering (AML) compliance programs, verify customer identities, and monitor and report suspicious activities.

Legal Compliance

Adherence to federal and state financial laws to ensure client protection. Continuous Development: Investment in research and development to improve asset freezing services and offer innovative financial solutions. Expert Collaboration: Working with teams of financial experts to develop and improve auditing and asset freezing tools.

Regulation Adherence

Full compliance with federal and state financial laws. For example, the Corporate Transparency Act requires companies to register beneficial ownership information with FinCEN and update it when changes occur. Financial Security: Ensuring client funds' safety and documenting all transactions transparently, including compliance with record-keeping and money transfer rules as mandated by U.S. laws.

Transaction Coordination

Audit and Verification: Using the latest technologies to audit and verify the legitimacy of funds, such as checking for suspicious activities and freezing suspected accounts until investigations are complete. This includes compliance with anti-money laundering laws and cooperation with government agencies like the FBI and regulatory bodies.

Client Communication : Immediate communication with clients to resolve any transaction issues, providing detailed reports on transaction statuses, and guiding clients through the investigation and audit process.

Business License : Licensing: Obtaining necessary licenses from U.S. government authorities, including federal and state licenses to provide asset freezing services.

Activity Monitoring: Regular monitoring of activities to ensure full compliance with financial regulations, including adherence to compliance procedures and transparency in financial dealings.

Investment Card : Issuing investment cards with unique numbers to document investment details and ensure compliance with agreed financial standards.

Allocation: Assigning distinctive numbers to groups of countries based on similar financial regulations.

- Audit Authority

- Authority Name and Abbreviation:

- Authority Name: Compliance Audit Bureau

- Abbreviation: CAB

About CAB: CAB is a regulatory authority specializing in auditing frozen or held funds to ensure compliance with U.S. financial laws, enhancing security and transparency in financial transactions.

Dispute Resolution:

Arbitration Committee: Establishing an independent committee to resolve disputes between CAB and CAF or between CAB and investors.

Quick Resolution: Encouraging rapid dispute resolution through mediation without resorting to legal actions.

CAB Goals and Responsibilities:

Security and Transparency: Ensuring the security and transparency of frozen funds and building trust among investors through thorough and comprehensive audits of all transactions.

Procedures: Auditing transactions and verifying their legitimacy, coordinating with CAF to ensure temporary fund freezes if transactions exceed allowed periods.

Commitments:

Data Protection: Commitment to protecting data provided during the audit process and preventing unauthorized access.

Full Cooperation: Collaborating with CAF to facilitate the audit process and temporary fund freezes. Legal Compliance: Adhering to all relevant financial laws in the United States, such as the USA PATRIOT Act and anti-money laundering regulations.

Relevant Laws:

USA PATRIOT Act:

Enacted after the September 11, 2001, attacks to strengthen anti-terrorism and anti-money laundering measures. Requires financial institutions to develop AML compliance programs, verify customer identities, and report suspicious activities.

Bank Secrecy Act (BSA):

Mandates financial institutions to maintain accurate records of financial transactions and report suspicious activities. Requires compliance with AML rules and customer due diligence procedures.

Corporate Transparency Act:

Requires companies to register beneficial ownership information with FinCEN and update it as necessary.

Aims to enhance transparency and prevent the misuse of legal entities to conceal illegal assets.

Funds Management Rules:

Include regulations related to managing and freezing financial assets in cases of suspected illegal activities.

Outline procedures for banks and financial institutions to freeze accounts and verify suspicious activities.

Financial Reporting and Compliance Laws:

Require financial institutions to submit regular reports to regulatory authorities about financial activities.

Include rules for reporting large and suspicious transactions and ensuring transparency in financial operations.

Detailed Insights from Research:

Legal Procedures for Freezing Accounts: Account freezes can occur due to various legal reasons, such as suspected fraudulent activities, unpaid debts, court orders, or bankruptcy cases. Account freezes typically require prior notices or warnings from the bank and can last until the underlying issue is resolved or the required documents are provided. Banks are obligated to inform account holders about the reason for the freeze and how to resolve the issue.

Anti-Money Laundering Laws: U.S. laws require banks and other financial institutions to follow strict AML procedures. These include monitoring unusual financial activities, reporting suspicious transactions, and verifying customer identities. Relevant legislation includes the USA PATRIOT Act and the Bank Secrecy Act. These laws aim to prevent the use of the financial system for illegal purposes and enhance financial security.

Transparency and Consumer Protection: U.S. laws mandate financial institutions to maintain transparency in their operations and protect consumer rights. In cases of unjustified account freezes, banks may face significant fines. For example, some banks have been fined for freezing accounts without adequate justification, leading to substantial financial compensation for affected consumers.

Cooperation with Government Agencies: U.S. AML laws require banks and financial institutions to cooperate with government agencies like the FBI and regulatory bodies. This includes providing the required information and conducting necessary investigations when illegal activities are suspected. Cooperation involves submitting regular reports on financial activities and facilitating access to information needed by the authorities.

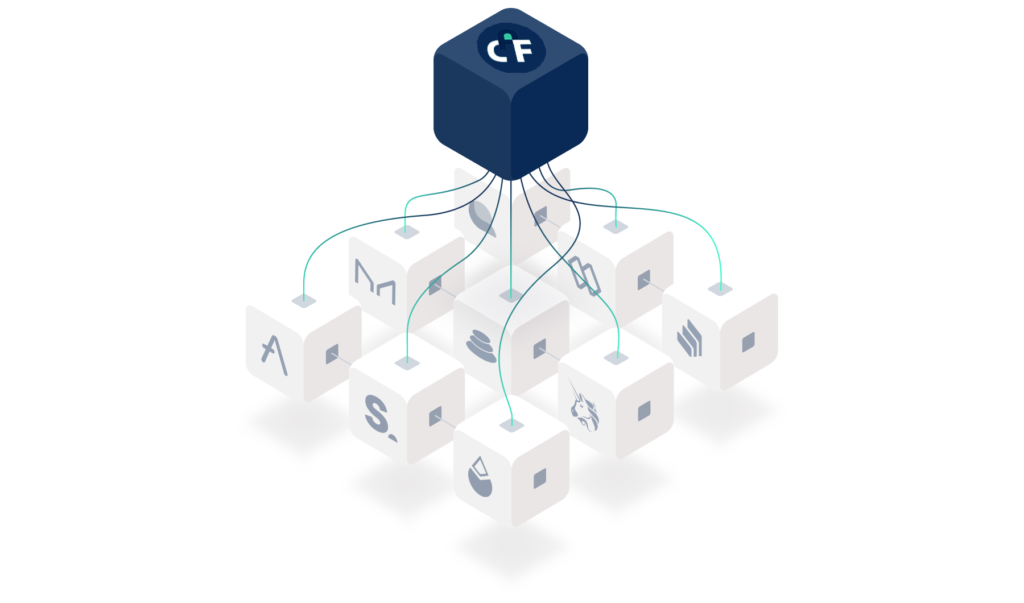

CAF and CAB work together to ensure full compliance with financial laws, protect client funds, and provide a secure and transparent financial environment. The freezing of financial assets is carried out in accordance with best practices and U.S. laws, focusing on transparency and consumer protection. The platform and the bureau aim to build trust among investors and financial institutions through strict adherence to financial regulations and offering innovative and effective solutions for asset freezing and legitimacy verification.

Asset Freezing for Illicit Activities

The Compliance Asset Freeze Platform (CAF) is tasked with freezing assets that are linked to illicit activities such as dealing with illegitimate funds, money laundering, terrorism financing, and other financial crimes. When violations by a company are uncovered, such as engaging in illegal transactions or being involved in fraudulent activities, CAF intervenes to freeze the company’s assets.

Asset Freezing for Illicit Activities

The Compliance Asset Freeze Platform (CAF) is tasked with freezing assets that are linked to illicit activities such as dealing with illegitimate funds, money laundering, terrorism financing, and other financial crimes. When violations by a company are uncovered, such as engaging in illegal transactions or being involved in fraudulent activities, CAF intervenes to freeze the company’s assets.

CAF Dealing

Dealing with Approved Entities Only At the Compliance Asset Freeze Platform (CAF), we exclusively engage with approved entities rather than directly with individuals. All requests and procedures must be conducted through recognized and licensed financial institutions and banks.

Reasons: Security and Reliability: Working with approved entities ensures we are dealing with trustworthy and licensed organizations, reducing the risk of fraud and illegal activities. Legal Compliance: Adherence to financial laws and regulations requires that all operations are conducted through officially recognized channels under regulatory supervision. Client Protection: Collaborating with approved entities ensures better protection of client funds and personal information, as these entities have the necessary expertise and technical capabilities to manage asset freezing operations effectively. Verification and Auditing: Engaging with accredited institutions facilitates the verification of the legitimacy of funds and the validation of all documents and information related to transactions, ensuring full compliance with financial laws. By adhering to these procedures, we ensure the provision of secure, transparent, and efficient asset freezing services, protecting the interests of all parties involved.